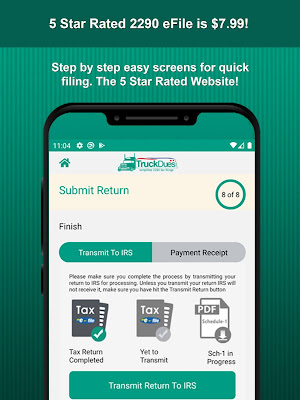

TruckDues Mobile App to eFile 2290 Tax Returns on the move

TruckDues Mobile App to report and pay the Federal Vehicle Use Tax Form 2290 returns with the IRS. Connect to the app from anywhere anytime to report and pay your Highway Vehicle Use Taxes. IRS watermarked Schedule 1 receipt is important for you and your business to keep everything intact. The safe and efficient 2290 tax reporting app can be handy when you need your 2290s done while you’re on road. Record keeping is easy, you can share your Schedule 1 PDF instantly by downloading it into your mobile phone from the app. This handy 2290 tax efile app is available for free download on your Android and Apple phones and tablets.

The app can keep you reminded of your due dates, the inbuilt calculator can allow you to plan how you can make the tax payments on time to the IRS. When you have a question, you can directly chat with our LIVE agents and get your questions answered.

Getting Start with 2290 eFile is easy, just create a personalized account with your email and phone number. Start adding your business and vehicle details one by one and pick an option on how you want to pay the IRS for the taxes you owe. Submit it and receive the Schedule 1 receipt instantly. To start with your 2290 return you would need all these details;

• EIN – Employer Identification Number

• Business Name with Address.

• VIN – Vehicle Identification Number

• Taxable Gross Weight

• Signing Authority Details

IRS mandates employer identification number to file your 2290 returns. You might not be able to file with your SSN. Always use your legal business name with the EIN, do not use a Doing business as name. IRS encourages to report 2290s online as it is easy and safe, can also process your return and issue back the Watermarked Schedule 1 proof without any delay. The IRS mandates electronic filing for truckers reporting 25 or more vehicles in a tax return. You have a bundle of features and merits to choose electronic filing for your 2290 tax reporting with TruckDues. We’re the Owner Operators and Small Trucking companies preferred choice to eFile 2290 returns, goes easy with your pockets and stress-free e-filing guaranteed.

2290 eFile is $7.99: The 2290 efile starts from $7.99 for a single vehicle return and the best price to efile 2290 returns with the IRS.

IRS Watermarked Schedule 1 in minutes: The fastest way to receive your IRS watermarked Schedule 1 proof, no delays and no excuses. Once IRS accepts and releases your Schedule 1 receipt it is made available in your dashboard and a copy is pushed to your email.

Text Alert: Subscribe for a Text on the return status. When there is an update from the IRS you will be notified by a text alert. In case of rejection, you can update the details and resubmit it instantly.

Fax Copies: Subscribe for our fax copies of the IRS Watermarked Schedule 1 receipt. The IRS watermarked stamp on the Schedule 1 should be legible while you present it with the DOT officials and other federal agencies.

Free VIN Correction: Correct your typo and misplaced VIN numbers instantly from the mobile app and receive back the Schedule 1 receipt in minutes.

Full Serviced 2290 eFile: When you are busy on wheels, we can get it filed for you and share with you the Watermarked Schedule 1 receipt in minutes. You decide how you want to share the tax data, by chat, by email or by calling our support number.

5-Star Rated Support and Service: We are rated top for the 2290 eFile service and support with the maximum trust score. Rated top for honest pricing and quality service.

2290 Call Support: Talk to our Support Desk at 347 – 515 – 2290, you can also write to us at support@truckdues.com. We’re working from 9:00 AM to 6:00 PM Central Time on all business working days. Reach us to serve you with the best 2290 eFiling service and receive IRS watermarked Schedule 1 receipt in minutes.

Comments